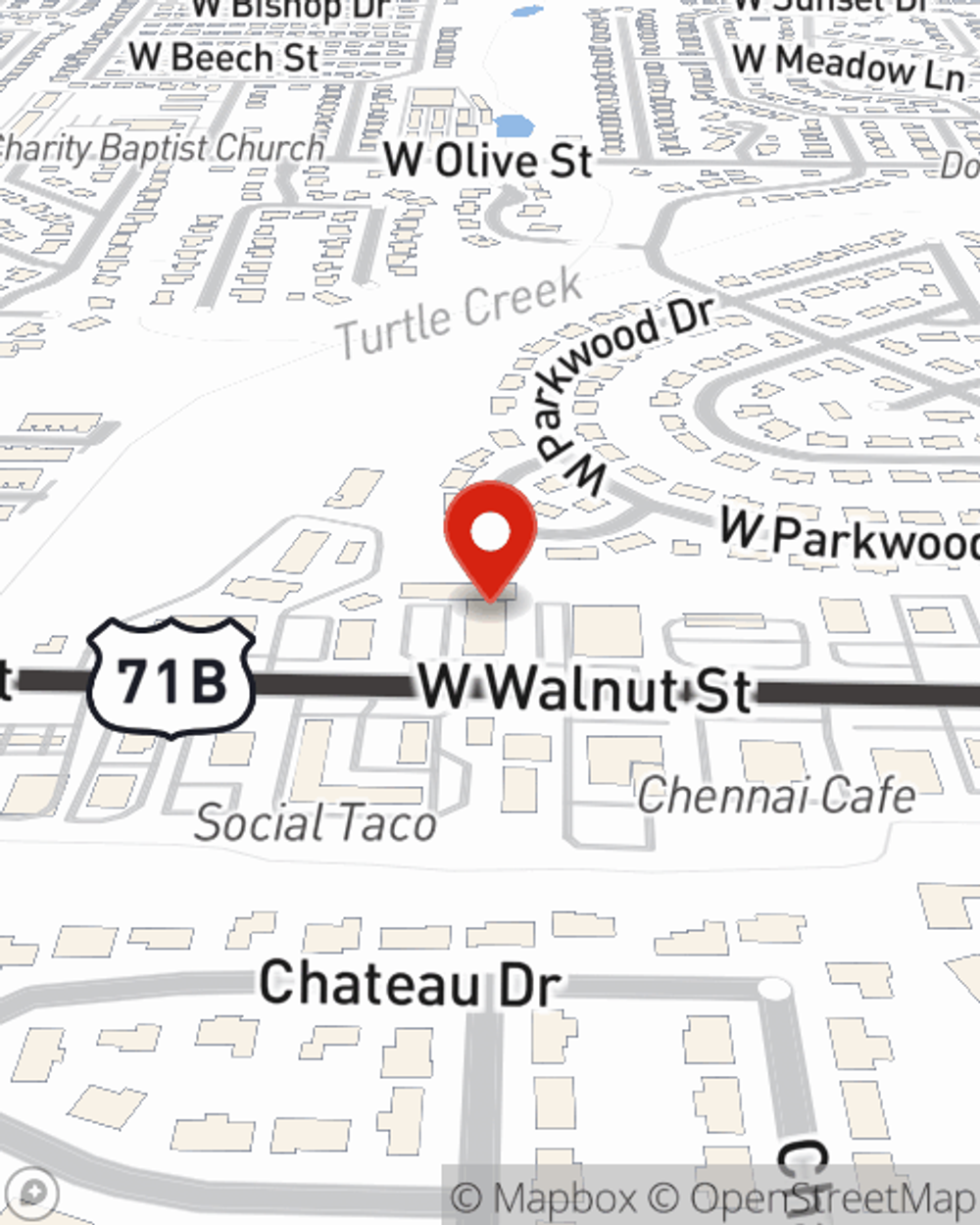

Life Insurance in and around Rogers

Life goes on. State Farm can help cover it

What are you waiting for?

Would you like to create a personalized life quote?

- Rogers, AR

- Pea Ridge, AR

- Lowell, AR

- Bentonville, AR

- Garfield, AR

- Springdale, AR

- Fayetteville, AR

- Centerton, AR

State Farm Offers Life Insurance Options, Too

When you're young and newly married, you may think Life insurance is only for when you get old. But it's a great time to start thinking about Life insurance to prepare for the unexpected.

Life goes on. State Farm can help cover it

What are you waiting for?

Wondering If You're Too Young For Life Insurance?

Life can be just as uncertain when you're young as when you get older. That's why now could be a good time to get Life insurance and why State Farm offers various coverage options. Whether you're looking for level or flexible payments with coverage to last a lifetime or coverage for a specific time frame, State Farm can help you choose the right policy for you.

Did you know that there's now a life insurance option available that's perfect for a person who thought they couldn't qualify? It's called Guaranteed Issue Final Expense and it can really be helpful when it comes to paying for final expenses like medical bills or funeral costs. Don't let these expenses burden your loved ones in the future - check out State Farm Guaranteed Issue Final expense from State Farm agent Karen Williams and see how you can be there for your loved ones—no matter what

Have More Questions About Life Insurance?

Call Karen at (479) 621-0259 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.

Karen Williams

State Farm® Insurance AgentSimple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.